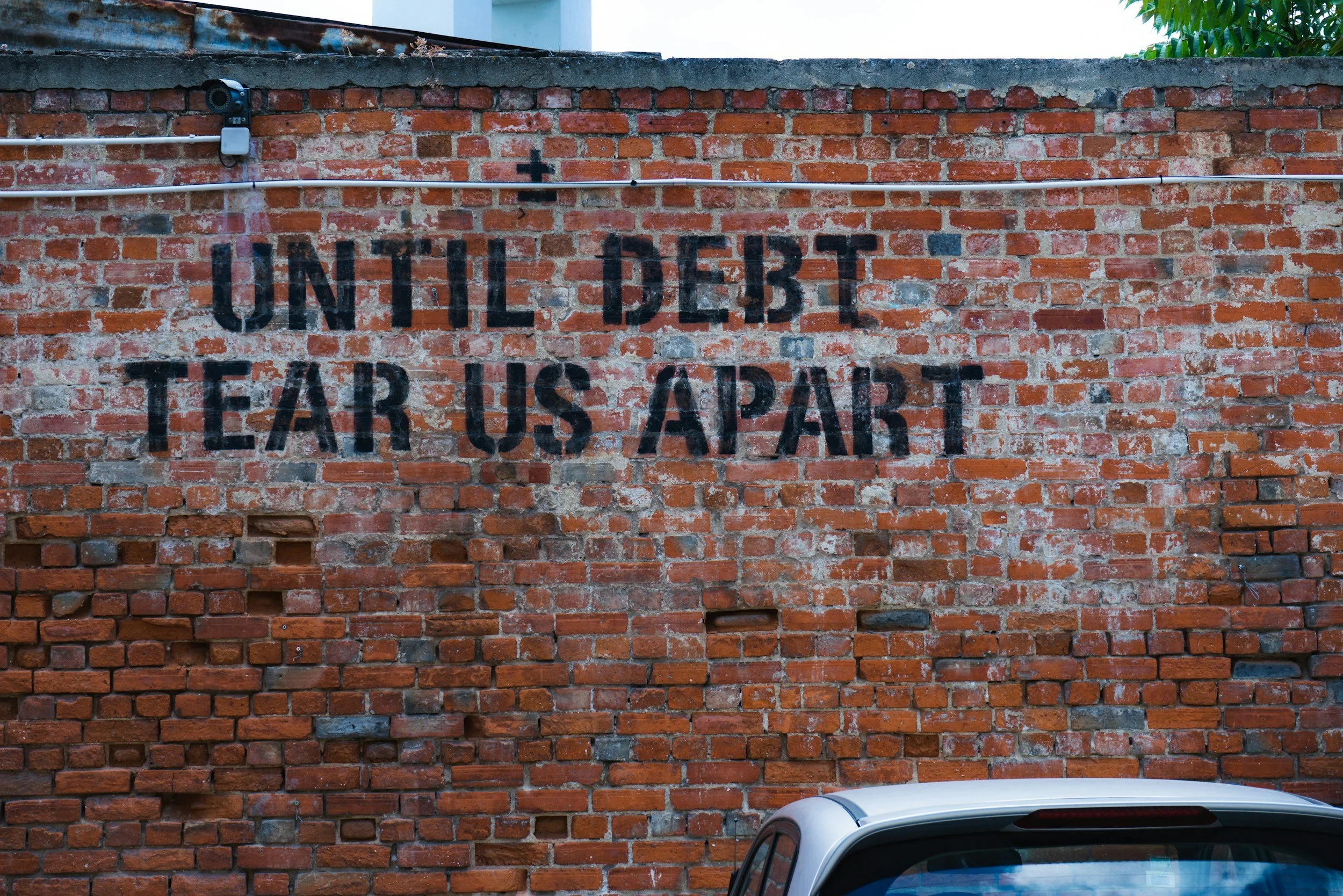

How debt consolidation can save you and ease your finances

Are you burdened with all kinds of debts? If you have credit card debts, personal loans, and other types of debts that have financial implications, it might appear to be a vicious circle. The good news is that debt consolidation loans can help you get out of this situation. In this blog post, today, we will discuss how a debt consolidation loan works, why it is good, and how you can get the best debt consolidation loan that suits you. You can also consider options to refinance your home loan to consolidate your debts. Let’s dive in!

What is debt consolidation?

Debt consolidation loan can be defined as the process of grouping multiple debts into a single loan/payment. You do not need to deal with different accounts that have different interest rates and expire dates, but unite them in one account. This would allow you to repay the debt in an easier and manageable manner. For example, if you have high-interest credit cards, you can consolidate the debt into a loan, which will pay off all your balances, leaving you with one loan instead of many. This will help you to just focus on clearing your debt without necessarily recalling the different due dates.

The benefits of debt consolidation

Simplified payments consolidation: This will mean that you will be paying once in a month instead of many times. This reduces the risks of paying late as well as keeping you organized.

Reduced interest rates: Most individuals use the debt consolidation loan to obtain a lower interest rate. This would prove cost-effective in the long run if you owe a large sum on high-interest credit cards, consolidating it into a loan with a lower interest rate is more cost-effective.

More rapid debt repayment

Debt consolidation loans would help you to have quicker debt repayment. The amount of interest paid to you will be lower, and you will have a structured repayment plan to clear the loan faster. It is perplexing to trace through different debts. When you are under a debt consolidation loan, you do not have to worry about making more than one payment and will help you relax significantly.

Types of debt consolidation loan

Personal loans for debt consolidation: Debt consolidation loan is a personal loan that can be applied to repay different loans. (A personal loan gives you a lump sum to pay off your existing debts. The loan is then repaid monthly.)

Balance transfer credit cards: This is where the amount of debts is transferred to a different card. Other credit cards also provide balance transfer services (that allow you to transfer multiple high-interest credit card balances to one with a lower interest rate). One of the best ways to consolidate credit card debt is by paying all balances in one instalment.

Home equity loans for debt consolidation: You can qualify for a home equity loan in the event if you own a home. This type of loan enables you to take out a loan using your home's equity to clear other debts. Home equity loans for debt consolidation would also be cheaper than credit cards and personal loans but beware, as you risk your home if you default.

Can we get debt consolidation loans with bad credit?

You might be wondering, what if I have a bad credit score? Does that still make me eligible to take a debt consolidation loan? The answer is yes! Having bad credit does not mean you cannot secure debt consolidation loans, although the terms may be less favourable.

However, it must be borne in mind that there are certain significant considerations:

Higher interest rates: Bad credit may not qualify you to get the lowest interest rates. This is because the lenders will regard you as being at a higher risk. It can, however, also be a smart move to take out a debt consolidation loan if it helps you pay off high-interest debt.

Consider a co-borrower: In case you are worried that your credit would affect your loan application being granted, you might request someone with a better credit to co-sign the loan. This can increase your chances of approval and should allow you to have an opportunity to obtain a lower interest rate.

Find alternative lenders: Other banks besides traditional banks, you can explore other lenders for debt consolidation loans. Even online lenders or credit unions are worth considering, as they may be more supportive of individuals with bad credit.

Debt consolidation steps

Now that you know what debt consolidation loan is and how it functions, you must now look at the steps which you can take in order to get the process started:

Your debt list: Review all your debts before you apply to have a debt consolidation loan. Include card balances, personal loans, and bills. This will help you know the amount of the debt that you can consolidate.

Check your credit score: The credit score also plays a role in the state you would find yourself in debt consolidation loan. If you have a low credit score, you may need to switch between lenders who accept bad credit.

Lenders: Debt consolidation loans are not alike. Compare interest rates, repayment terms, and fees from different lenders to find the best deal. Another thing to look at is the loans that have a fixed interest rate so you know exactly what you'll pay monthly.

Apply to the loan: Once you have found the right lender, you are in a position to apply for your loan. You will be asked to provide information including details about your debt, income as well as credit score. When the lender provides the loan, the lender will provide the funds to clear your debt.

Pay off your debts: After obtaining the loan, use the loan to clear all your debts. To this effect, make sure that you use the full sum of the loan so that you end up with no unutilized sums.

Stick to the plan: You should bear in mind that since you have already consolidated your debt, you should stick to your new repayment program. Make timely payments to pay in time, and strive to be no longer in the practice of running new debts.

Conclusion

Debt consolidation loans are among the most effective techniques to simplify your finances and make them more economical in the long run. With a poor credit score or with high-interest debt, it is possible to escape the predicament and start fresh. By consolidating your debts, you will be able to pay just once a month and focus on clearing them. Once you are ready to control your money, consider a debt consolidation loan. You should make sure that you shop around and come up with a decision that fits. Get out of debt and look forward to financial freedom today, take the first step!

Need to simplify your debt and save more? The information on the debt consolidation loans is in the pipeline, call us for the best options!

Frequently asked questions

1. What is a debt consolidation loan, and how does it help simplify my finances?

A debt consolidation loan combines multiple debts into a single loan, making it easier to manage repayments with one monthly payment, often at a lower interest rate, simplifying your finances.

2. Can I get a debt consolidation loan with bad credit?

Yes, you can still secure a debt consolidation loan with bad credit, though the terms might not be as favorable. You may face higher interest rates or need a co-signer to improve your chances.

3. What are the benefits of debt consolidation for credit card debt?

Debt consolidation for credit card debt allows you to consolidate high-interest credit card balances into a single loan with a lower interest rate, saving you money on interest and simplifying payments.

4. How do home equity loans for debt consolidation work?

Home equity loans for debt consolidation allow you to borrow against your home’s equity to pay off other debts. This type of loan often offers lower interest rates but comes with the risk of foreclosure if you fail to repay.

5. What steps do I need to take to apply for a debt consolidation loan?

To apply for a debt consolidation loan, list all your debts, check your credit score, compare lenders’ interest rates and terms, and apply for the loan with the right lender that offers the best deal for your situation.

Table of Contents

Important stuff:

Please note that the views and opinions expressed in this post are general information only, and this is not financial advice.

Any advice and information is provided by Buyvest Pty Ltd ABN 91 684 841 496, Australia Credit Licence No. 567392 and is general in nature, for educational purposes only and is not intended to constitute specialist or personal advice. This website has been prepared without considering your objectives, financial situation or needs. Therefore, consider the appropriateness of the advice for your situation and needs before taking any action. It should not be relied upon to enter into any legal or financial commitments. Specific investment advice should be obtained from a suitably qualified professional before adopting any investment strategy. If any financial product has been mentioned, you should obtain and read a copy of the relevant Product Disclosure Statement and consider the information contained within that Statement concerning your circumstances before deciding whether to acquire the product. You can obtain a copy of the PDS by emailing hello@buyvest.com.au. If you want to change your financial circumstances, such as applying for a loan, all loan applications are subject to credit approval.

All information on this website is subject to change without notice.